Digital transformation has become a necessity for businesses seeking efficiency, security, and compliance. Among the most impactful innovations, Digital Signature Certificates (DSC) enable organizations to streamline workflows, enhance security, and reduce operational costs. However, seamless integration with existing IT infrastructure is crucial for maximizing these benefits.

The Importance of Digital Signature Integration

Businesses across industries rely on digital signatures to authenticate and validate transactions securely. Key advantages include:

- Faster approval processes by eliminating manual paperwork.

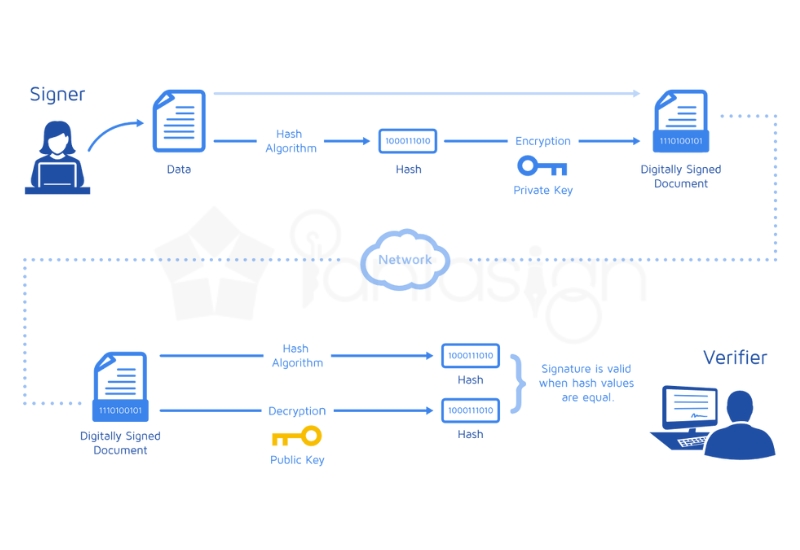

- Enhanced security through encryption and fraud prevention.

- Legal recognition under the Information Technology Act, 2000.

- Reduced costs by eliminating paper, printing, and courier expenses.

- Improved sustainability with paperless operations.

Common Applications of Digital Signatures

- E-Tendering and procurement for secure vendor contract signings.

- GST and income tax filings for legally binding digital authentication.

- HR and employee on-boarding for secure document execution.

- Legal agreements and business contracts for tamper-proof verification.

- Banking and financial transactions for fraud-proof digital approvals.

Steps for Integrating Digital Signatures into Business Systems

Identifying Business Requirements and Use Cases

Understanding where digital signatures add value is the first step. Businesses must assess their workflows and determine whether they require standalone DSC-based signing or full API integration for automated processes.

Selecting the Right Digital Signature Solution

Different types of digital signature certificates serve various purposes:

- Class 3 DSC for e-tendering, financial transactions, and government filings.

- eSign API for seamless integration with enterprise applications.

- USB Token-Based DSC for secure offline authentication.

Organizations handling high volumes of digital documents should consider cloud-based eSign APIs for scalability and automation.

API and Software Integration

Most enterprises adopt digital signatures through:

- API-Based Solutions for direct integration with ERP, CRM, and document management systems.

- Third-Party Software such as Adobe Sign or Docu-Sign for plug-and-play usability.

- Cloud-Based e-Sign Services that allow remote document signing without additional hardware.

The chosen DSC provider should offer compliance support and easy-to-integrate solutions for business continuity.

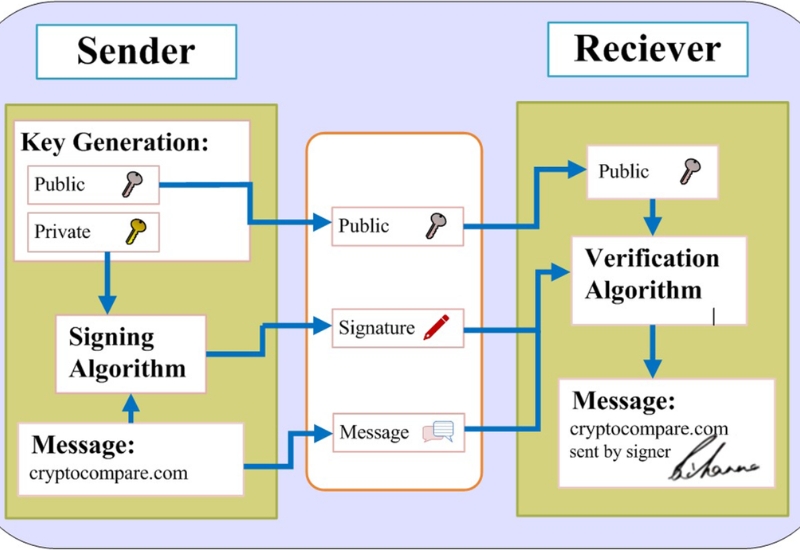

Security and Compliance Implementation

To ensure a secure digital signature infrastructure, organizations should implement:

- Multi-factor authentication to prevent unauthorized access.

- Time-stamping for legal validity and document authenticity.

- Audit trails to maintain detailed records for compliance audits.

Regulatory adherence is crucial, and businesses should select a DSC provider that complies with the Information Technology Act, 2000.

Employee Training and Workflow Optimization

Successful digital signature integration requires:

- Employee training on secure and efficient use of DSC.

- Automation of document approval workflows for improved efficiency.

- Role-based access control to ensure secure and authorized document handling.

Organizations that transition to digital signatures report faster turnaround times and cost savings due to reduced manual processes.

Future-Proofing Business Operations with Digital Signatures

Integrating digital signatures enhances security, efficiency, and compliance in a business environment increasingly driven by digital transformation. Key benefits include:

- Increased efficiency through automated document execution.

- Enhanced security with encrypted, tamper-proof authentication.

- Legal recognition for regulatory and financial transactions.

- Cost-effective, sustainable alternatives to traditional paper-based processes.

Organizations looking to modernize their workflows should explore Pantasign Digital Signature Solutions for seamless integration and enhanced operational efficiency.

For more information visit www.pantasign.com, or contact us today +91-8171444411.

Powered by Froala Editor